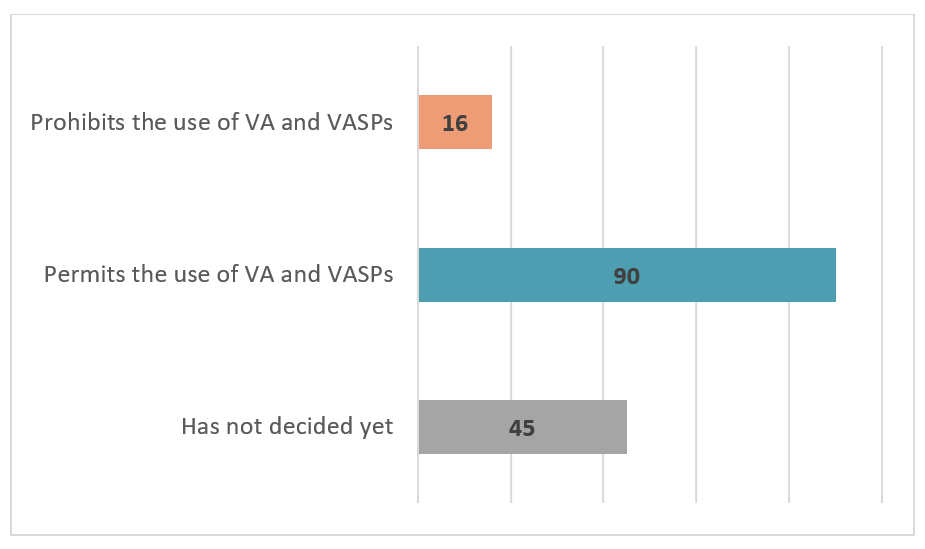

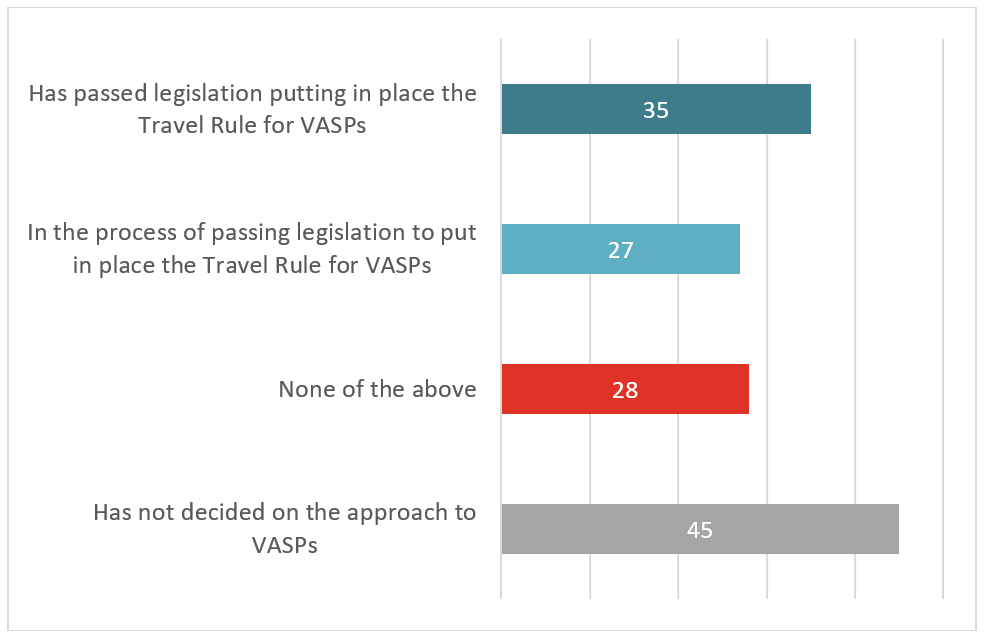

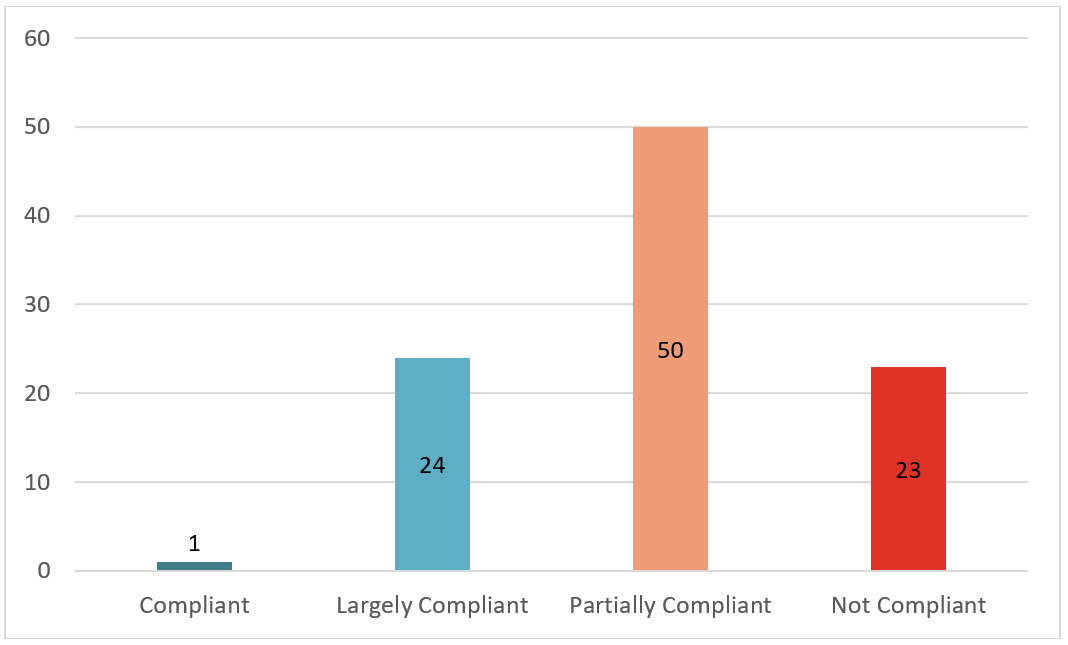

FATF's report finds that jurisdictions continue to struggle with fundamental requirements such as undertaking a risk assessment, enacting legislation to regulate VASPs, and conducting a supervisory inspection. Based on 98 FATF mutual evaluation and follow-up reports since the revised R.15/INR.15 was adopted, 75% of jurisdictions are only partially or not compliant with the FATF’s requirements. In addition, jurisdictions have made insufficient progress on implementing the Travel Rule, which is a key AML/CFT measure. Of the 151 jurisdictions that responded to FATF’s 2023 Survey, more than half still have not taken any steps towards implementing the Travel Rule. This is a serious concern as the risks posed by VAs and VASPs continue to increase and that the lack of regulation creates significant loopholes for criminals to exploit. This demonstrates an urgent need for jurisdictions to accelerate implementation and enforcement of R.15/INR.15 to mitigate criminal and terrorist misuse of VA and VASPs.

FATF’s report acknowledges collaboration among the private sector members to improve industry compliance with R.15/INR.15 including the Travel Rule and highlights that all players need to have appropriate risk identification and mitigation measures and continue to work towards fully compliant Travel Rule compliance tools.

While DeFi and unhosted wallets including P2P do not account for a large share of transactions, they are at risk of misuse, including by sanctioned actors. The FATF will therefore continue to monitor the illicit financing risks and developments in this sector.

The FATF calls on all countries to rapidly implement the FATF’s Standards on VAs and VASPs, including the FATF’s Travel Rule. In February 2023, the FATF adopted a roadmap to improve implementation of R.15. In line with this roadmap and to address the findings of this report, the FATF will:

- Continue to conduct outreach and provide assistance to low-capacity jurisdictions

- Identify and publish steps FATF member jurisdictions and other jurisdictions with materially important VASP activities have taken towards implementing R.15/INR.15

- Facilitate sharing of finding, experiences, and challenges including relating to DeFi, unhosted wallets, and P2P and monitor market trends in this area for material developments that may necessitate further FATF work

- Continue to engage with member countries and the private sector on progress and challenges

- Conduct a further review on progress and remaining challenges for implementation by June 2024

Twitter

Twitter

Facebook

Facebook

Instagram

Instagram

Linkedin

Linkedin